A Q&A with Logic’s Xavier Mougeot

Global Managing Director

Digital

The lines between physical and digital channels are disappearing as retailers look to achieve a state of unified commerce. For example, in the past, markdown strategies were something that only applied to stores. Today, data-driven retailers are increasingly finding success by weaving together physical stores and digital commerce in order to optimize their overall markdown strategies.

We recently sat down with Logic’s Global Managing Director for Digital, Xavier Mougeot, to learn how retailers can enhance their markdown strategies by leveraging their digital channels.

Xavier, what are some of the ways that digital commerce can help support a retailer’s markdown strategy?

- Reducing the need for markdowns in the first place.

- Driving traffic to your store to boost sell-through.

- Providing a rapid test-and-learn environment for refining your markdown pricing.

What commerce strategies can help reduce the need for markdowns in the first place?

But there’s another option. What if, instead of trying to generate demand among your store’s existing consumers (who already took a ‘pass’ on the merchandise at full price) you could use the store’s merchandise to satisfy full-price demand coming from elsewhere? By adopting unified commerce strategies, retailers can do just that.

With unified commerce, you can build consumer journeys where your store inventory serves as a fulfillment option for digital orders. In this way, your overstocked store can satisfy full-priced demand that’s coming from a much larger geographic area than the store itself could serve.

Yes, there may be additional costs to shipping from that store, but with some intelligent order orchestration ensuring you only fill profitable orders, you can stay well ahead of the margin hit that you would have taken with a markdown.

How can a retailer’s digital channels drive traffic to stores to boost sell-through?

Here’s an example—I consult with a major retailer here in North America. When a consumer shops with that retailer digitally, the local store experience is woven in right from the start. The retailer’s commerce sites and apps are smart enough to know you’re in the radius of a store, and your search results will feature all the relevant local inventory that exists in that store. The customer is then presented with buy-online-pick-up-in-store (BOPIS) as well as local delivery alongside standard e-commerce fulfillment options. The retailer can even provide customers an ETA for when they can expect the order to be ready (e.g., in 20 minutes). This gives the retailer an additional lever to drive store traffic and improve sell-through.

And here’s where “drive-to-store” journeys get really interesting: Imagine you’re able to leverage both your digital consumers’ in-the-moment actions, as well as the entire history of their interactions with your brand. With that level of insight, you can personalize that “drive-to-store” experience based on the individual consumers’ preferences and price sensitivities, as well as your business goals—in this way, you’re driving sell-through while minimizing markdowns. In other words, you can present the right offers, to the right consumers, at the right moment.

Or to approach this another way, for consumers who have a history of making full-priced purchases, you could display the markdown offer alongside complementary items, ‘also bought with’ products, or family products—all at full price, and therefore increasing the market basket value and margins.

→ Get the Guide

How can digital channels serve as a test-and-learn option for pricing, such as markdown pricing?

One of the most promising areas where a digital test can inform your in-store markdown strategy is price sensitivity. If you read our eBook, The Complete Retail Markdown Planning Guide: 8 Ways to Boost Performance, you know that price sensitivity data is a key input to your markdown planning model. But this data can be hard to come by, especially with seasonal items or in fashion and apparel where an item’s life cycle only lasts a single season.

That’s where your e-commerce sites and apps can save the day. By launching a price sensitivity test, you can quickly understand how significantly a pricing change will impact sell-through. We are often surprised in our work with clients by how much even a small markdown—as little as 5%—can have a big impact on sales. You can then take those insights and feed them into your store markdown model, helping you guide your strategy from the very beginning of your markdown cycle.

What kinds of systems and requirements do retailers need in order to use their digital channels to support their overall markdown strategy?

A unified markdown strategy requires a unified, flexible commerce ecosystem, including optimization platforms, A/B and multivariate testing, AI-driven merchandising, and of course unified data across all channels that provides access to granular pricing, markdown, and inventory information.

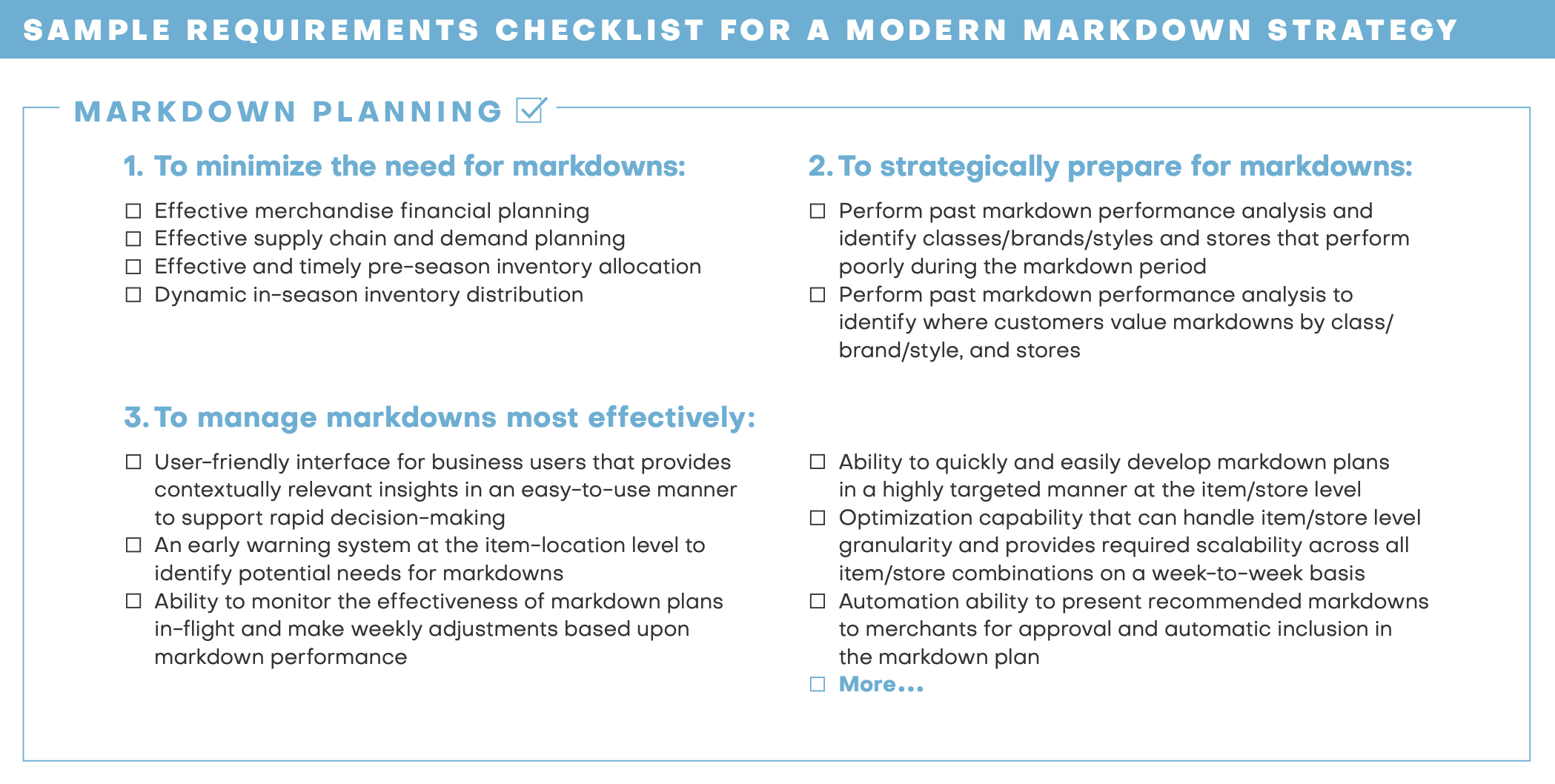

To learn more, check out our markdown guide, which features both a best-practice intelligent markdown tech stack and a checklist of requirements to help get you started.

At Logic, we help you assess the systems and requirements you have in place, and then work with you to design and execute a roadmap that moves you up the maturity curve so you can deliver ever-improving business results using real-world strategies. We do that across the Digital practice I lead, as well as in Logic’s other practices, whether it be in Data and analytics, Stores, Cloud, or Merchandising.

As the Global Managing Director of Logic’s Digital practice, Xavier Mougeot drives the next wave of commerce experiences and innovation at Logic. Xavier has led commerce strategies and customer experiences for companies including Rogers Communications, Stanley Black & Decker, General Motors, Mary Kay, AT&T, Sobeys, and Pfizer.