By Graeme McVie

Global Managing Director

Data

Retailers have always had opportunities for improvement when it comes to markdown planning. However, a series of unprecedented events, from supply chain shocks and inflation to an uncertain economy, is making it more critical than ever for retailers to employ effective markdown planning strategies today.

Ongoing Forecasting Challenges Cause Excess Inventory

In a survey of retail leaders conducted by RSR, 63% of respondents said that customers have become more price sensitive than ever, and 48% said that COVID has made it almost impossible to create accurate demand forecasts.

What’s more, these market trends are being felt by retailers regardless of size or stature. According to a recent CNBC article:

- Abercrombie & Fitch and American Eagle Outfitters reported a steep increase in inventory levels, up 45% and 46% respectively.

- Target said it had about 43% higher inventory than in the same period last year.

- Walmart’s inventory levels were up about 33% compared with a year ago.

To get out of the current inventory bind—and to be ready for similar challenges in the future—retailers need a new way forward with their markdown strategies. That’s why Logic made markdowns the topic of our latest research, “The Complete Retail Markdown Planning Guide: 8 Ways to Boost Performance.”

In the guide, we begin by discussing the typical status quo for how many retailers manage markdowns—uniform decisions across all stores and all items on a “how we’ve always done it” cadence with respect to timing and depth of discount.

However, in order to preserve margins and hit sell-through goals in the face of today’s challenging inventory situation, retailers should consider a more sophisticated approach. By doing so successfully, they can navigate their way out of this extraordinary set of circumstances. And have the processes and technology in place to achieve more success season after season into the future.

Stop Taking a Broad Brush Approach: Get Granular With Your Markdown Planning

To maximize margins and accurately manage sell-through, retailers must move beyond broad-brush approaches and adopt a granular strategy that optimizes the depth and timing of discounts both at the item and store levels.

With the data and insights to confidently skip markdowns at locations where an item is selling well, you’ll preserve margins and recover revenue. For areas with excess inventory of that same item, you’ll use forecasting and price elasticity insights to apply just enough depth of markdown at the right time to hit sell-through targets—often with fewer step-downs and more shallow overall discounts versus typical approaches to markdowns.

Fewer price adjustments also make it easier for your store operations staff who won’t need to manage as many shelf label changes and floor resets. Wherever possible, you’ll also keep assortments intact later into the season, providing a better shopping experience for customers.

For retailers who can achieve granularity in their markdown strategies, the results can be impressive, including:

- 10%+ improvements in gross margin dollars

- 10%+ improvements in sell-through

- 5% increase in revenue

- Reduced inventory carrying costs

- Increased cash flow and working capital

Scaling Your Markdown Decision Processes is the Key

With hundreds of thousands to millions of data points to evaluate, the sheer amount of information involved in making granular markdown decisions exceeds what humans can do manually, even with the help of a spreadsheet. To get it right, the people charged with making these decisions need to be supported with a highly scalable, systematic approach.

When we talk about scalability, we’re not only speaking in terms of computing horsepower but also in terms of how you manage it on the human side.

Today’s markdown solutions solve both challenges. For retailers who are serious about upping their markdown game, the ultimate destination is a solution that enables total store markdown optimization capability. You can set up your objectives, your strategies, and your rules, and then you can use the underlying technology to suggest what the markdown depth should be, what the markdown timing should be, and the length of that markdown. All down at the item-store level.

To make it easy on merchants but still provide total control, the optimization solution does the heavy lifting and presents recommendations alongside the forecasted impact on sales, profit, and the sell-through rate. Merchandisers review the data and recommendations, confirm their goals will be achieved, and with a mouse click can instantly operationalize their markdown decisions for downstream execution.

Chart Your Course Towards Total Store Markdown Optimization

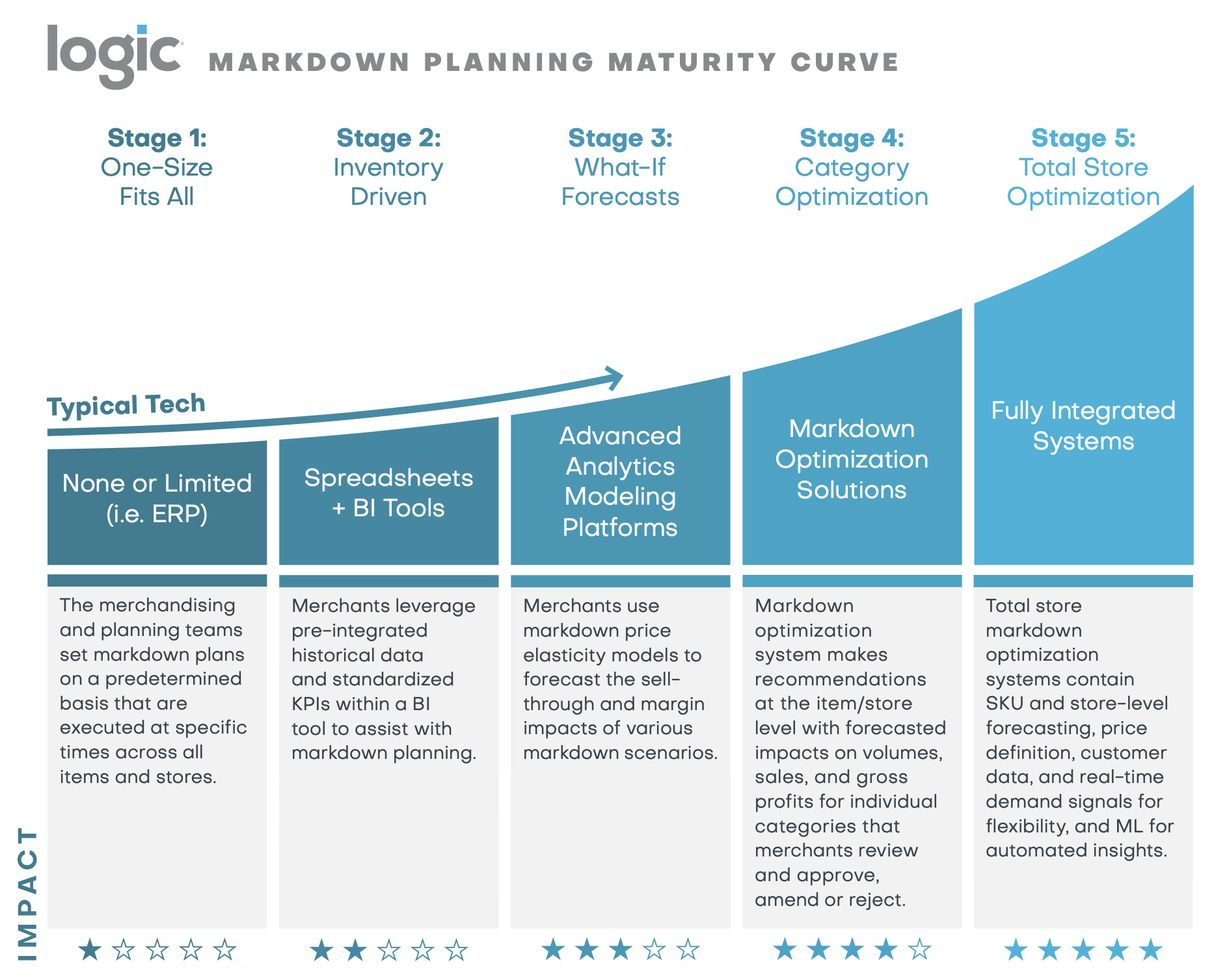

In transitioning from your current markdown approach and towards best-practice, state-of-the-art processes, Logic advocates for a crawl-walk-run approach. To that end, we’ve developed a five-stage markdown maturity curve as presented in Logic’s recent guide.

Today, many retailers live in Stage 1: One-Size Fits All of the Markdown Planning Maturity Curve. Generally, these retailers are manually dumping data into spreadsheets. Merchants will look into inventory levels for select items, compare them to sales rates to predict excess inventory at end-of-life, and then employ a broad-brush markdown approach. Here’s a brief summary of how retailers tend to work in Stage 1:

Stage 1: One-Size Fits All

- Typical Tech: None or limited (i.e., ERP)

- Capabilities: Corporate markdown plans set with defined start dates, discount depts, and cadences. The markdown plan is implemented across all stores and items at the same time.

- Process: The merchandising and planning teams set markdown plans on a predetermined basis, and execute them at specific times across all items and stores.

- Impact: ★☆☆☆☆

Our maturity model can help you identify where you stand, how to get to the next stage of maturity, and discover the value it brings. Below is a snippet of the rest of the stages and their impacts. Be sure to download the full guide to help you identify where your business stands today:

Get Started on Improving Your Markdown Planning Today

Regardless of where your business stands today in the markdown planning maturity curve, there are quick wins you can achieve. Starting small makes room for big value upfront, and allows you to demonstrate ROI at every step along the way toward total store optimization.

At Logic, we help our clients determine where they are today on the maturity curve and where to go next to find value. Choosing the right first step is especially crucial for those retailers who have an immediate need to deliver business improvement during a current selling season. At the same time, we can help you build toward a longer-term strategy, and achieve it in a scalable way.

After you’ve downloaded the guide, feel free to explore the Data practice I lead and the challenges we can help you solve, as well as Logic’s additional practices in Merchandising, Stores, Digital, and Cloud. We are here to help deliver value in the short term while also executing your broader vision. See how we can help you bring it all together.

In his capacity as Global Managing Director of Logic’s Data practice, Graeme helps our clients leverage their data and analytics to make decisions that ensure competitive success. Graeme is an established thought leader with deep domain knowledge in the retail and consumer brands sectors. He’s an expert in advanced analytics in the areas of merchandise planning and optimization, shopper centricity, retailer/supplier collaboration, and customer segmentation. In his 25-plus years of consulting experience, he has worked with top-tier retailers and brands such as Target, CVS, Best Buy, IKEA, Macy’s, Kraft, and Coca-Cola.